Custodial roth ira calculator

Retirement Savings Calculator. What You Need To Know About The Custodial.

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

. If for example your. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. For comparison purposes Roth IRA.

Compare 2022s Best Gold IRAs from Top Providers. Married filing jointly or head of household. With the Roth IRA calculator you can get an idea of how much your earnings can grow if you start making contributions at a young age.

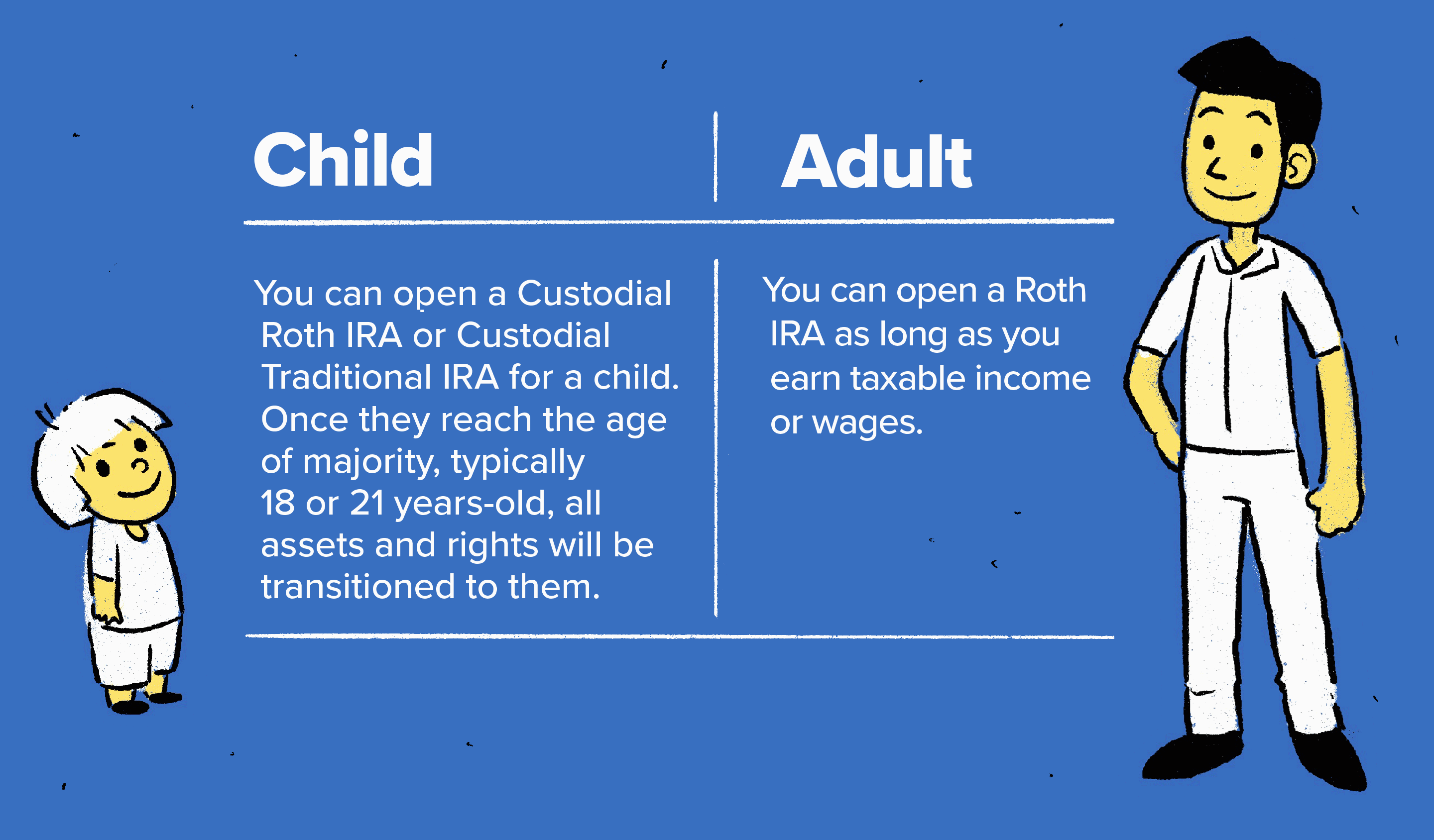

A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income. Ad Visit Fidelity for Retirement Planning Education and Tools. Retirement Nest Egg Calculator.

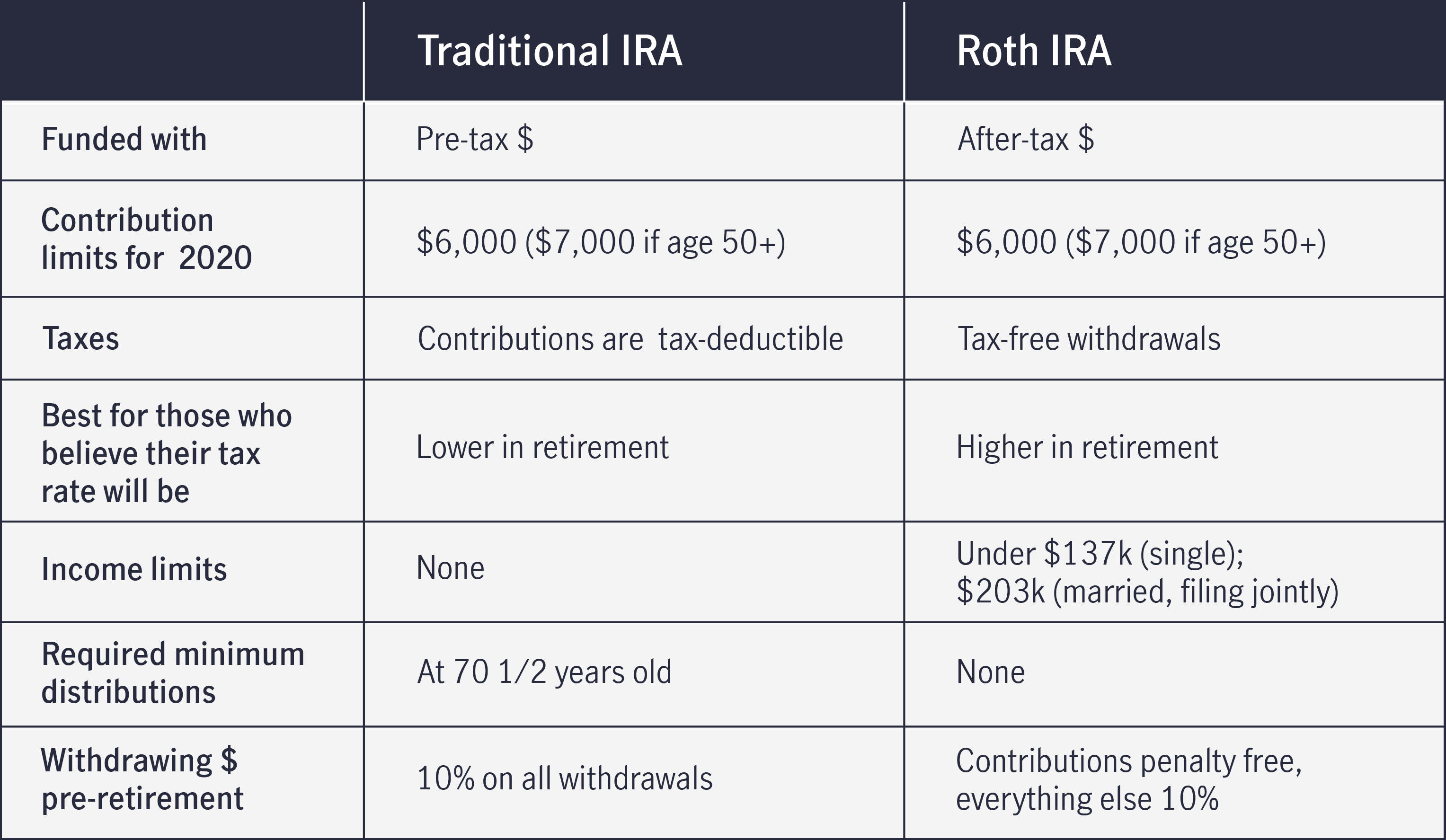

Traditional IRA calculator Choosing between a Roth vs. Traditional IRA Calculator can help you decide. For the purposes of this.

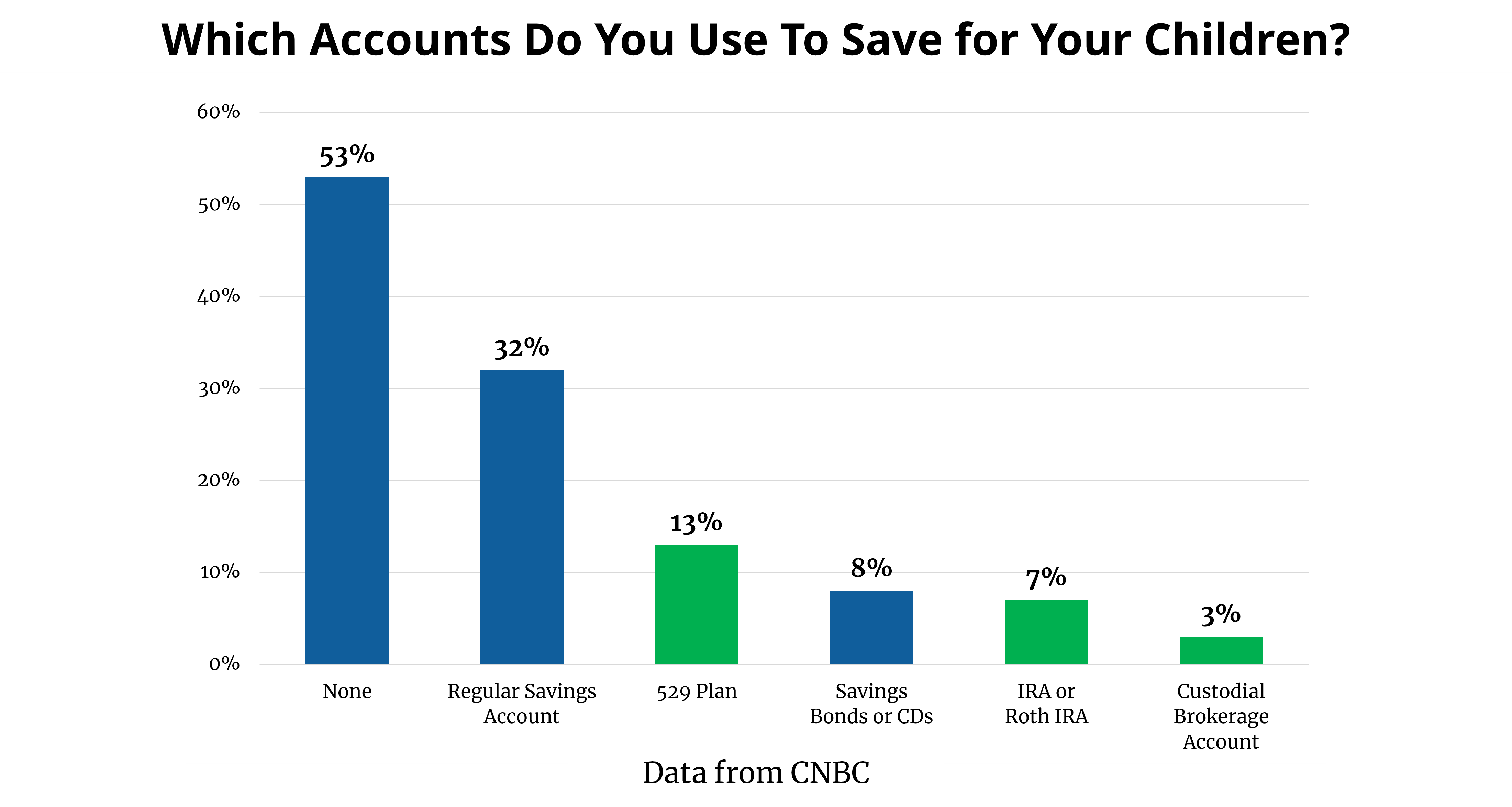

Converting to a Roth IRA may ultimately help you save money on income taxes. Open An Account In 10 Minutes. The table below offers a fairly comprehensive outline of.

Learn More About IRAs On Our Official Site. For instance if you expect your income level to be lower in a particular year but increase again in later years. Roth IRA Calculator Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

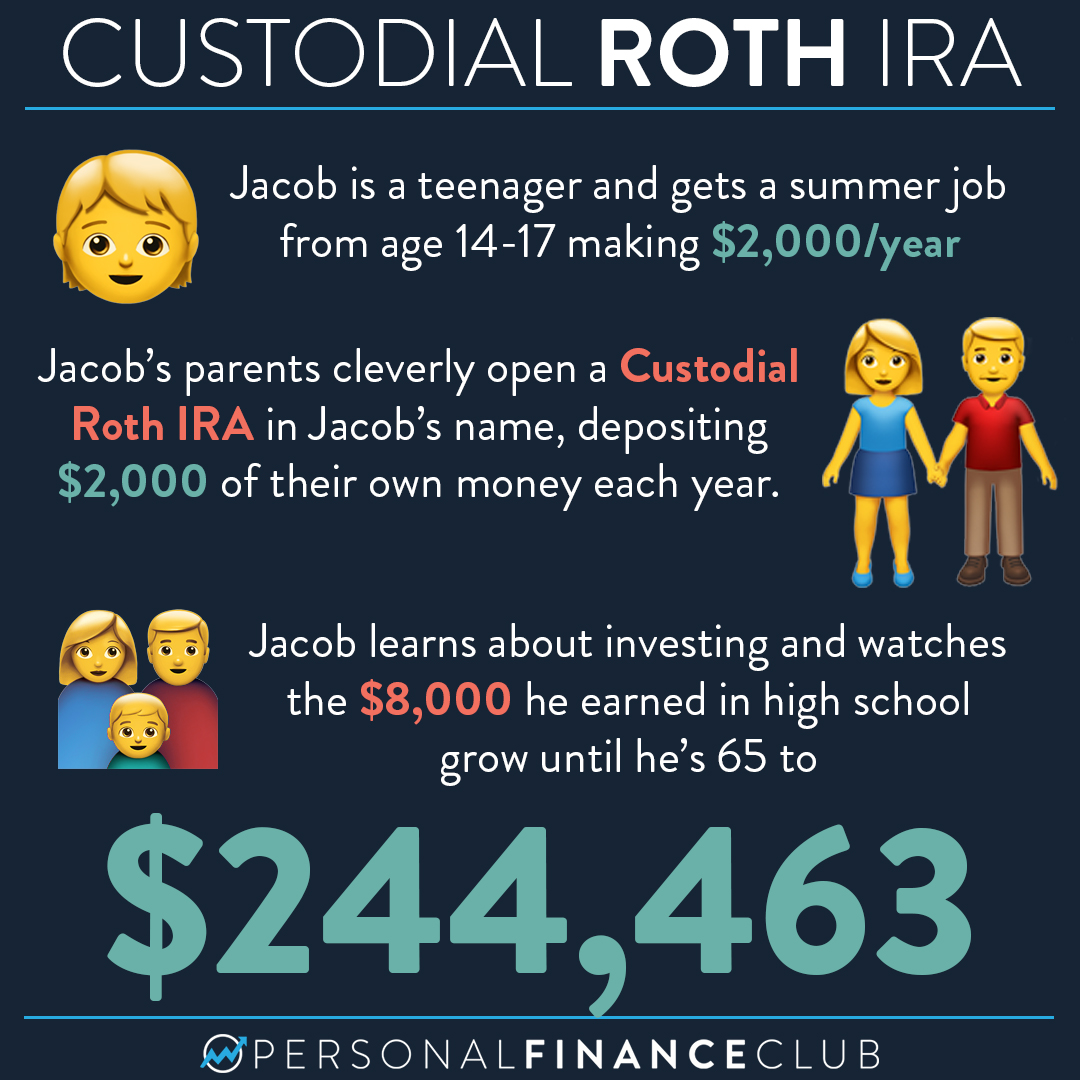

Ad Visit Fidelity for Retirement Planning Education and Tools. Ad TIAAs IRA Contribution Calculator Can Help Determine Your Contribution Limits. For example if your child earned 3000 mowing lawns theyd be.

Open An Account Online In As Little As 10 Minutes. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

Find a Dedicated Financial Advisor Now. Ad Lets Partner For All Of Lifes Moments. Do Your Investments Align with Your Goals.

For 2021 the contribution limit for custodial Roth IRAs is 6000 or the total amount of money that your child made during the year whichever is less. In the case of a custodial Roth IRA this means your child must have earned income to contribute or for you to contribute on their behalf. As of 2022 the IRS allows contributions.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. A custodial Roth IRA is managed on behalf of the account owner by an. The Roth IRA contribution limit in 2021 is the lesser of 6000 or your childs total compensation for the year.

With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement. Custodial Roth IRAs convert to Roth IRAs when the minor turns 18 years old 21 years in some states. Fidelity Investments introduced a free online Roth IRA conversion calculator last month to both its independent registered investment advisers and.

Once the Custodial IRA is open all assets are managed by the. You can adjust that contribution. The custodian maintains control of the.

Traditional IRA depends on your income level and financial goals. Ad Access Premium Research And Tools. Reviews Trusted by Over 45000000.

A Full-Service Experience Without the Full-Service Price. Married filing jointly or head of household. For the purposes of this.

Minors cannot generally open brokerage accounts in their own name until they are 18 so a Roth IRA for Kids requires an adult to serve as custodian.

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

A Roth Ira At Age 15 Thanks To The Parent Match

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

How To Open A Roth Ira 5 Easy Steps Seeking Alpha

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

How Every Teenager Can Become A Millionaire Pragmatic Mom

What Is A Roth Ira Money Com

How Every Teenager Can Become A Millionaire Pragmatic Mom

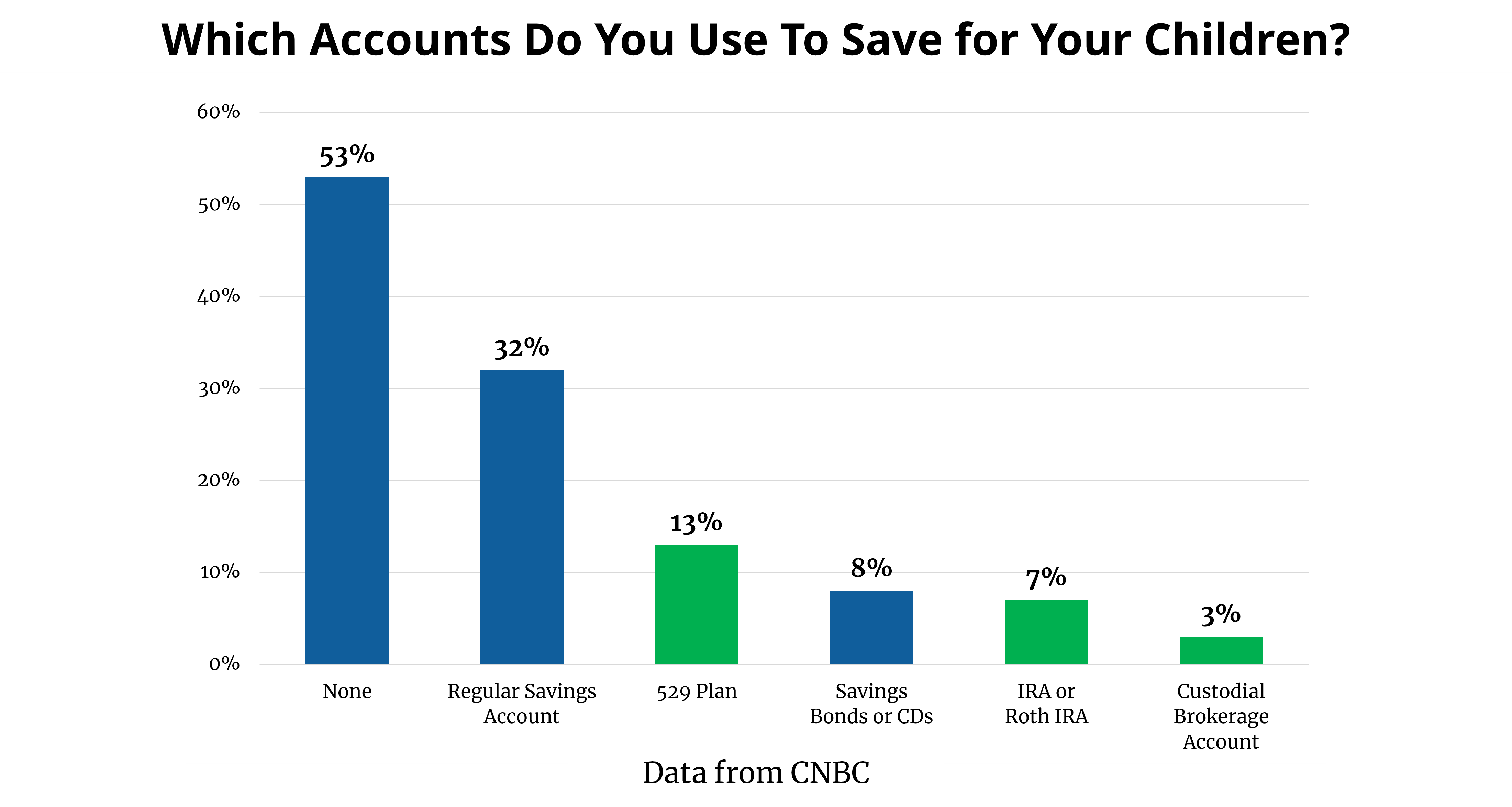

The Best Ways To Save For Kids By Daniel May Cfp

How To Open Your First Ira Sofi

Comparing Traditional Iras Vs Roth Iras John Hancock

Roth Ira Calculator How Much Could My Roth Ira Be Worth

How A Custodial Ira Can Give Your Child A Head Start On Retirement Savings T Rowe Price

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

How To Open A Custodial Roth Ira For Your Kids Personal Finance Club